TX-SDEED-8-26 free printable template

Show details

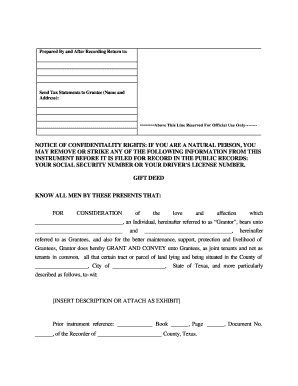

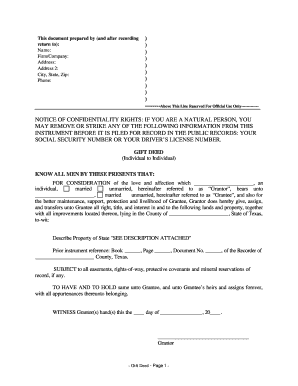

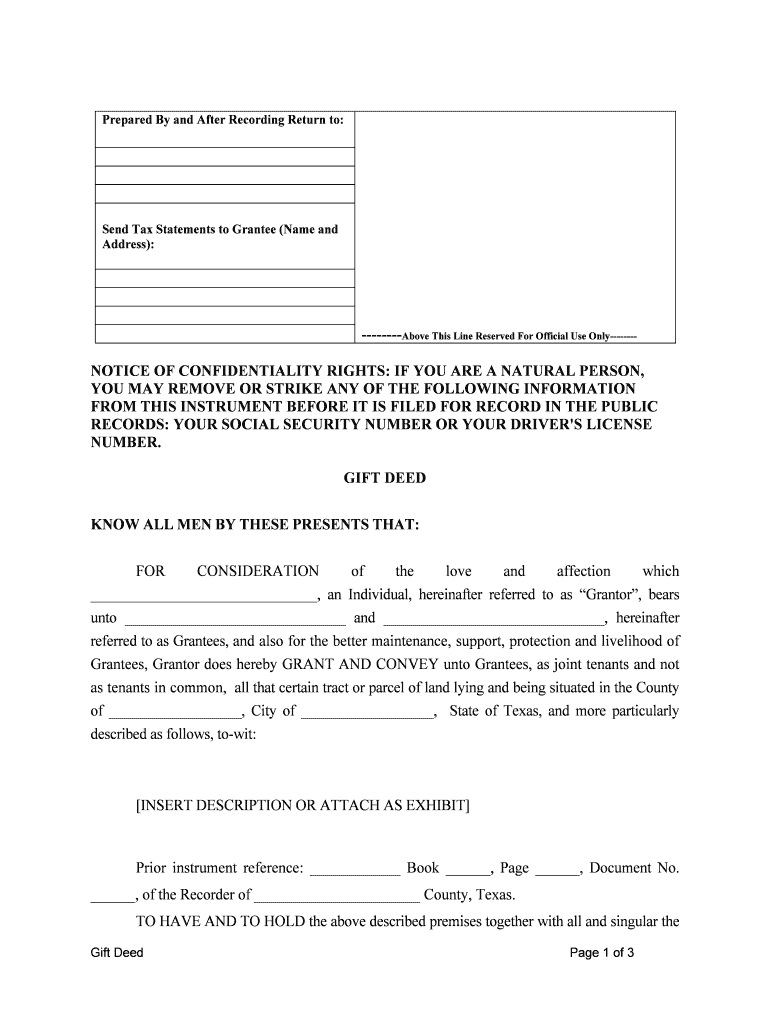

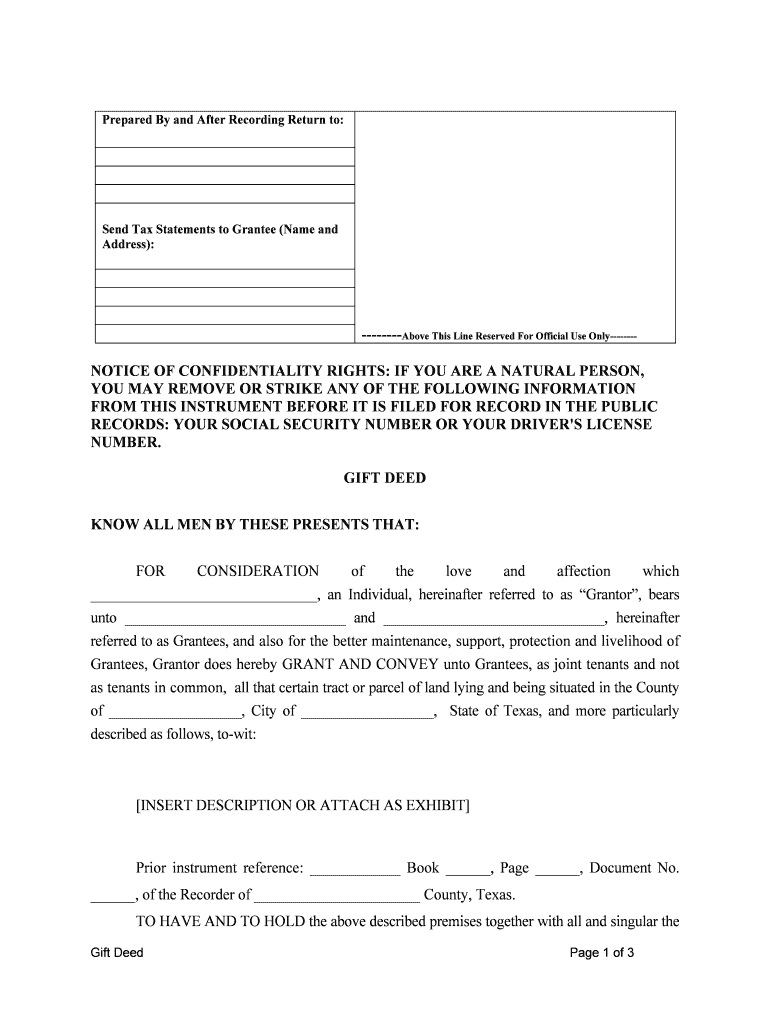

Prepared by U.S. Legal Forms, Inc. Copyright 2016 U.S. Legal Forms, Inc. STATE OF TEXASGIFT DEED Individual to Individuals as Joint Tenants Control Number TXSDEED826NOTE ABOUT COMPLETING THE FORMS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign texas gift deed form

Edit your texas gift deed pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your texas gift deed form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing texas gift deed sample online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit texas gift deed template form. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift deed form pdf

How to fill out TX-SDEED-8-26

01

Obtain the TX-SDEED-8-26 form from the appropriate Texas state website or office.

02

Fill in the date at the top of the form.

03

Provide the names of the grantor(s) (seller) and grantee(s) (buyer).

04

Include the legal description of the property being transferred.

05

Specify the consideration amount, which is the value exchanged for the property.

06

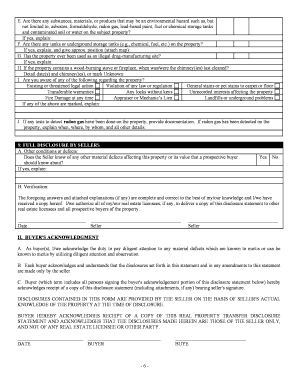

Check the appropriate box indicating whether the transfer is subject to a lien or not.

07

Fill in the county where the property is located.

08

Sign and date the form where required, ensuring all parties have signed.

09

Submit the filled-out form to the county clerk's office for recording.

Who needs TX-SDEED-8-26?

01

Individuals or companies involved in the buying or selling of real estate in Texas.

02

Attorneys handling property transfers or real estate transactions.

03

Real estate agents or brokers facilitating transactions.

04

Lenders or financial institutions involved in mortgage financing.

Fill

texas gift form

: Try Risk Free

People Also Ask about tx gift deed

How do I transfer property to a family member tax free Texas?

In order to gift a house or other real estate to a family member, the current owner of the property will need to sign a Gift Deed to give the property to the family member.

How do I file for a gift deed in Texas?

These deeds need to be in writing and signed by the person giving the property in front of any notary. Once it has been properly prepared and signed, the deed needs to be filed with the county clerk for the county in which the property is located. The county will charge a filing fee of about $30 to $40.

How to transfer a property deed to a family member in Texas?

Transfers of real property must be in writing and notarized. Deeds should be recorded in the county where the property is located. To ensure a legal change to the property title, you'll want the services of an attorney. A qualified attorney will prepare and file the real estate transfer deed.

Do you have to pay taxes on a gift deed in Texas?

Texas also has no gift tax, meaning the only gift tax you have to worry about is the federal gift tax. The gift tax exemption for 2022 is $16,000 per year per recipient, increasing to $17,000 in 2023.

How do you write a gift letter deed?

How To Write a Gift Letter The exact dollar amount of the gift. The donor's name, address, and phone number. The donor's relationship to the loan applicant. The date when the funds were or will be transferred. A statement that no repayment is expected. The address of the property being purchased (if known at the time)

How does a gift deed work in Texas?

Gift Deeds in Texas As its title indicates, the gift deed transfers ownership of property as a gift; the person providing the gift, the grantor, expects nothing in return for the transfer. The property is a free gift with no strings attached.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gift deed form directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign gift deed form sample and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit deed individual individuals straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing gift deed individual right away.

How do I complete gift deed joint on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your gift deed individuals. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is TX-SDEED-8-26?

TX-SDEED-8-26 is a form used in Texas for reporting certain real estate transactions and title transfers.

Who is required to file TX-SDEED-8-26?

Individuals or entities involved in the transfer of real property in Texas are typically required to file TX-SDEED-8-26.

How to fill out TX-SDEED-8-26?

To fill out TX-SDEED-8-26, provide details about the property, the buyer, the seller, and the nature of the transaction as specified on the form.

What is the purpose of TX-SDEED-8-26?

The purpose of TX-SDEED-8-26 is to ensure the accurate reporting of property transfers for tax assessment and record-keeping purposes.

What information must be reported on TX-SDEED-8-26?

The form requires information such as the property's legal description, the names of the parties involved, the type of transaction, and sales price.

Fill out your gift deed texas form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank Gift Deed Form Texas is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.